OAKLAND, Calif. — A Chinese startup has come out of stealth mode with promises to cut the price of solid state disk (SSD) technology in half. The company, Sage Microelectronics, is currently shipping an SSD controller IC capable of packing up to 5 terabytes on a single PCB with a standard 2.5-inch form factor.

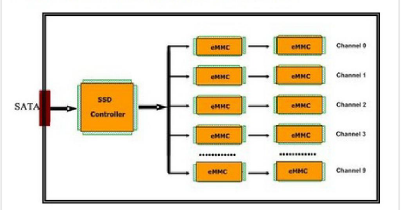

Sage Micro’s SSD controller can address up to 5 TB of flash memory using a SATA II interface to drive 10 channels of SSD, MMC, or eMMC flash memory cards, with each channel supporting up to 512 GB of flash memory. The company aims to solve issues around fast updates in flash speeds and limited bus speeds by taking the problem to a “higher level of abstraction.”

“A single SoC controller is driving multiple channels of eMMC cards, and each MMC controller is driving multiple levels of flash die,” Sage Micro president Chris Tsu told EE Times. “Our approach has flash memory and multiple flash controllers. The controller chip addresses each of the eMMC chips individually and by doing that they can address much higher density.”

Sage developed a propriety multi-core architecture for its SSD controller with a single small RISC CPU core managing the SATA bus and additional cores that handle two memory card channel interfaces each. Sage’s S68X family of SSD controllers can support 4, 5, and 10 memory channels for less than $5 per controller.

“A proprietary controller is key in the sense of getting flash to survive in an enterprise setting,” Alan Niebel, president of WebFeet Research, told EE Times. “The overall quality may not stand up against time; it’s tough to know how good proprietary quality is.”

Sage Micro did not note the processing power behind its controllers, although speed may be the key to differentiating the company among its competitors. Jim Handy, principal analyst with Objective Analysis, said the parallel architecture in Sage’s controller is reminiscent of supercomputers and may, in fact, be really fast.

“They’ve got a bunch of controllers controlling flash chips separately, that ought to give them a bit more bandwidth. You would think that performance would scale with the number of eMMC cards,” Handy told us. “It seems if their minimum system is four eMMCs and a controller, that’s already one more processor than what Samsung has, and it should lend to higher performance.”

Tsu added that by providing a proprietary controller, Sage Micro bypasses the problem of working with flash suppliers that don’t publish internal details of controllers that can run multiple generations of flash. Those flash suppliers also have a higher price point for multiple chips than is truly necessary.

“A memory card includes underlying flash memory, and a flash controller is priced almost the same as underlying flash memory itself,” Tsu said. “eMMC should be more expensive, but it’s not. The reason is because of manufactured volume” of cellphones that need flash.

Sage Micro contracts with TSMC competitor SMIC to make its silicon, and said it can offer an SSD at $0.50 per gigabyte -- half the industry average. Additionally, Tsu said the use of JEDEC-compliant memory cards instead of discrete flash ICs enables SSD manufacturers to mix-and-match inventory to further reduce testing cost.

Sage hopes its price point, alongside its customizable controller, will enable the company to target markets larger flash providers haven’t been able to touch. Tsu said he isn’t worried about competing with larger flash vendors, because most of that market is focused on embedded systems.

“We want to dominate the low end and low capacity market in China. In the US, we’re targeting datacenters and specific applications where many of the other vendors aren’t competing. Big [flash vendors] are competing in laptop computers and very large market spaces,” Tsu said.

While Neibel said there is room for Sage to succeed in the niche industrial/commercial market -- which currently includes Apacer and Virtium -- he was a bit skeptical about the company’s staying power.

“They could make it in that marketplace, but they have to be more versatile than just the SATA II kind of interface -- they’ll need to get into different form factors like M2, and over time they will have to move to NVMe,” he said.

There is much Chinese government backing for Tsu’s vision, which came in part from the Micro Electronics Research Institute at Hangzhou Dianzi University in China, where Sage CEO Weidong Liu is a director. China wants to build its semiconductor manufacturing base.

“We’re trying to build a 100 TB SSD array network in China for schools. We are affiliated with Hangzhou Dianzi University and are trying to build a terabyte space for our architecture to demonstrate during the first quarter of next year,” Tsu told us. “A typical application is virtual desktop infrastructure. VDI is very popular in schools because students are bringing their own computers and using the cloud.”

本文翻译:

奥克兰,加州报道:一个来自中国的创业公司崭露头角,其SSD控制器技术可成倍降低固态硬盘的价格。这个公司就是杭州华澜微科技有限公司(Sage Microelectronics Corp)。目前它正在量产交货标准2.5寸规范的单PCB密度达2.5TB的固态硬盘。

杭州华澜微科技有限公司发布了支持5TB密度的新架构SSD控制器芯片。这款芯片采用SATA-II接口,可以驱动10通道SD, MMC, eMMC闪存卡,每个通道可支持高达512GB。华澜微通过把算法提到更高层架构的办法,来解决快速提升的闪存速度和有限的总线速度之间的矛盾。

“一个SoC控制器驱动多路的eMMC卡片,并且每个MMC控制器驱动多级闪存。”华澜微的楚传仁先生告诉我们。“我们的方法有多个闪存和多种闪存控制器。每个控制器芯片管理单独的eMMC芯片,从而更容易实现高密度大容量。”

华澜微SSD主控是一种专利的多核架构设计,其中一个RISC处理器掌控SATA总线管理,其余多核每核处理两个闪存卡通道。华澜微S68X系列SSD控制器支持4路、5路、10路通道,所有型号均处于量产状态,批量单价低于5美元。

“一个专有的控制器是FLASH相关企业生存的关键”。WebFeet 研究中心总裁Alan Niebel告诉记者。“总体质量可能并不受时间影响,很难想象专有权带来的好处”。

华澜微并没有披露其控制器背后的处理能力,虽然速度可能是与竞争对手区分开来的关键。Objective Analysis的首席分析师Jim Handy说,华澜微主控的并行体系结构让人回忆起超级计算机,而且可能,实际上,速度真的很快。

“他们有一群控制器分别控制闪存芯片,这将为他们获得更多的带宽。可以想象,由eMMC卡片的数量来成比例地扩展提升性能”,Handy告诉我们。“包含四个eMMC和一个控制器的最小系统,这已经比三星控制器多了一个处理器,似乎可望达到更好性能。”

楚传仁补充说道:通过提供一个专利保护的控制器,华澜微可以绕过使用FLASH的问题,免于应付复杂的FLASH管理算法和频繁更新的FLASH 型号。闪存供应商们也会为其多样的芯片报出一个比实际更高的价格。

“一个存储卡包括内置的闪存,而一个FLASH控制器的价格和内置闪存的价格几乎相同。eMMC应该更贵,但实际不是这样的,这是因为大量的手机生产商需要FLASH”, 楚传仁说道。

华澜微通过台湾积体电(TSMC)的竞争对手上海中芯国际(TSMC)代工制作硅片,并表示可以提供0.50美元每GB的SSD,行业均价的一半。此外,楚传仁说,使用符合JEDEC标准协议的存储卡,取代使用离散的IC厂商的存储卡,能够通过支持固态硬盘制造商混搭库存从而进一步降低测试成本。

华澜微希望他们的价格,用他们的可定制的控制器,使公司目标市场扩大至闪存供应商一直无法触及的领域。楚传仁认为,他从不担心与更大的FLASH 供应商竞争,因为大部分的市场是专注于嵌入式系统的。

“在中国,我们想要占据低端,低容量的存储市场。在美国,我们专注于数据中心和特殊应用,在那,与我们与其他的供应商没有竞争。大的FLASH供应商都在笔记本电脑和其他大的市场中竞争。“

然而Neibel说,华澜微在特色化的工业/商业市场中是有成功的空间的,包括Apacer and Virtium,但他对公司的持续力量保持怀疑。

“他们可以应用在这个市场上,但应该具有更多的通用性不是局限于SATA II 一种接口。

对楚傳仁的雄心,背后有很多中国政府的支持,部分来自杭州电子科技大学的微电子研究中心。华澜微的首席执行官骆建军担任着杭州电子科技大学微电子研究中心的主任。中国正在中国正在建立半导体生产制造中心。

“我们正努力在中国的高校建立100TB的固态硬盘网络阵列。我们立足于杭州电子科技大学,明年第一季度,我们将用华澜的架构建设一个TB空间里展示,虚拟桌面基础结构的一个典型应用。虚拟桌面基础架构在高校中非常流行,学生可以通过他们自己的电脑使用云服务。

——杰西卡·利普斯基,副主编,电子工程时报

奥克兰,加州报道:一个来自中国的创业公司崭露头角,其SSD控制器技术可成倍降低固态硬盘的价格。这个公司就是杭州华澜微科技有限公司(Sage Microelectronics Corp)。目前它正在量产交货标准2.5寸规范的单PCB密度达2.5TB的固态硬盘。

杭州华澜微科技有限公司发布了支持5TB密度的新架构SSD控制器芯片。这款芯片采用SATA-II接口,可以驱动10通道SD, MMC, eMMC闪存卡,每个通道可支持高达512GB。华澜微通过把算法提到更高层架构的办法,来解决快速提升的闪存速度和有限的总线速度之间的矛盾。

“一个SoC控制器驱动多路的eMMC卡片,并且每个MMC控制器驱动多级闪存。”华澜微的楚传仁先生告诉我们。“我们的方法有多个闪存和多种闪存控制器。每个控制器芯片管理单独的eMMC芯片,从而更容易实现高密度大容量。”

华澜微SSD主控是一种专利的多核架构设计,其中一个RISC处理器掌控SATA总线管理,其余多核每核处理两个闪存卡通道。华澜微S68X系列SSD控制器支持4路、5路、10路通道,所有型号均处于量产状态,批量单价低于5美元。

“一个专有的控制器是FLASH相关企业生存的关键”。WebFeet 研究中心总裁Alan Niebel告诉记者。“总体质量可能并不受时间影响,很难想象专有权带来的好处”。

华澜微并没有披露其控制器背后的处理能力,虽然速度可能是与竞争对手区分开来的关键。Objective Analysis的首席分析师Jim Handy说,华澜微主控的并行体系结构让人回忆起超级计算机,而且可能,实际上,速度真的很快。

“他们有一群控制器分别控制闪存芯片,这将为他们获得更多的带宽。可以想象,由eMMC卡片的数量来成比例地扩展提升性能”,Handy告诉我们。“包含四个eMMC和一个控制器的最小系统,这已经比三星控制器多了一个处理器,似乎可望达到更好性能。”

楚传仁补充说道:通过提供一个专利保护的控制器,华澜微可以绕过使用FLASH的问题,免于应付复杂的FLASH管理算法和频繁更新的FLASH 型号。闪存供应商们也会为其多样的芯片报出一个比实际更高的价格。

“一个存储卡包括内置的闪存,而一个FLASH控制器的价格和内置闪存的价格几乎相同。eMMC应该更贵,但实际不是这样的,这是因为大量的手机生产商需要FLASH”, 楚传仁说道。

华澜微通过台湾积体电(TSMC)的竞争对手上海中芯国际(TSMC)代工制作硅片,并表示可以提供0.50美元每GB的SSD,行业均价的一半。此外,楚传仁说,使用符合JEDEC标准协议的存储卡,取代使用离散的IC厂商的存储卡,能够通过支持固态硬盘制造商混搭库存从而进一步降低测试成本。

华澜微希望他们的价格,用他们的可定制的控制器,使公司目标市场扩大至闪存供应商一直无法触及的领域。楚传仁认为,他从不担心与更大的FLASH 供应商竞争,因为大部分的市场是专注于嵌入式系统的。

“在中国,我们想要占据低端,低容量的存储市场。在美国,我们专注于数据中心和特殊应用,在那,与我们与其他的供应商没有竞争。大的FLASH供应商都在笔记本电脑和其他大的市场中竞争。“

然而Neibel说,华澜微在特色化的工业/商业市场中是有成功的空间的,包括Apacer and Virtium,但他对公司的持续力量保持怀疑。

“他们可以应用在这个市场上,但应该具有更多的通用性不是局限于SATA II 一种接口。

对楚傳仁的雄心,背后有很多中国政府的支持,部分来自杭州电子科技大学的微电子研究中心。华澜微的首席执行官骆建军担任着杭州电子科技大学微电子研究中心的主任。中国正在中国正在建立半导体生产制造中心。

“我们正努力在中国的高校建立100TB的固态硬盘网络阵列。我们立足于杭州电子科技大学,明年第一季度,我们将用华澜的架构建设一个TB空间里展示,虚拟桌面基础结构的一个典型应用。虚拟桌面基础架构在高校中非常流行,学生可以通过他们自己的电脑使用云服务。

——杰西卡·利普斯基,副主编,电子工程时报